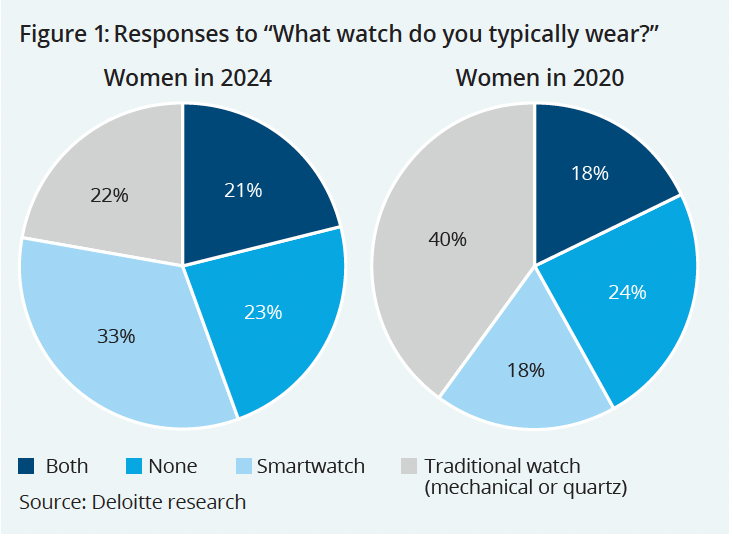

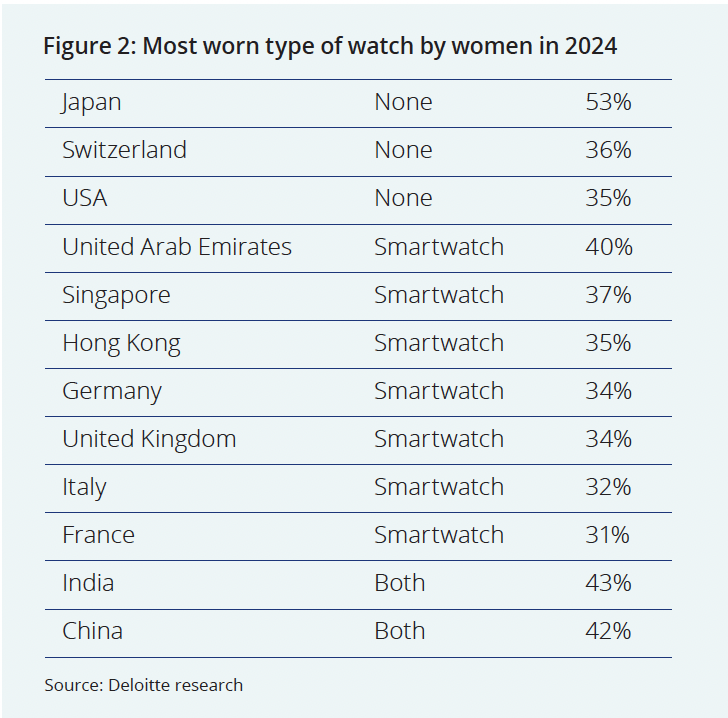

Despite increased attention from brands, numerous questions relating to the female watch consumer have still to find a satisfactory answer. For example, why are women significantly less visible in the watch market, compared with men, when they make up the majority of luxury consumers? Why are luxury watches still widely considered a masculine preserve? Why are the most prestigious examples of watchmaking virtuosity almost exclusively reserved for the male wrist? In an attempt to answer these questions, Deloitte surveyed* 6,000 consumers in collaboration with Watch Femme. This Geneva-based community, dedicated to promoting women’s voices within the watch world, added insight with its survey of 107 (mostly female) watch consumers and industry professionals.

First, an observation: despite composing 43% of the Swiss watchmaking workforce, women are significantly under-represented in leadership roles and positions of authority. They also earn substantially less than their male counterparts. Figures published by Unia, Switzerland’s largest trade union, show that women in the Swiss watch industry are paid on average 25% less than men: a wider pay gap than in other sectors of the economy. An illustration of how the watch world views women?