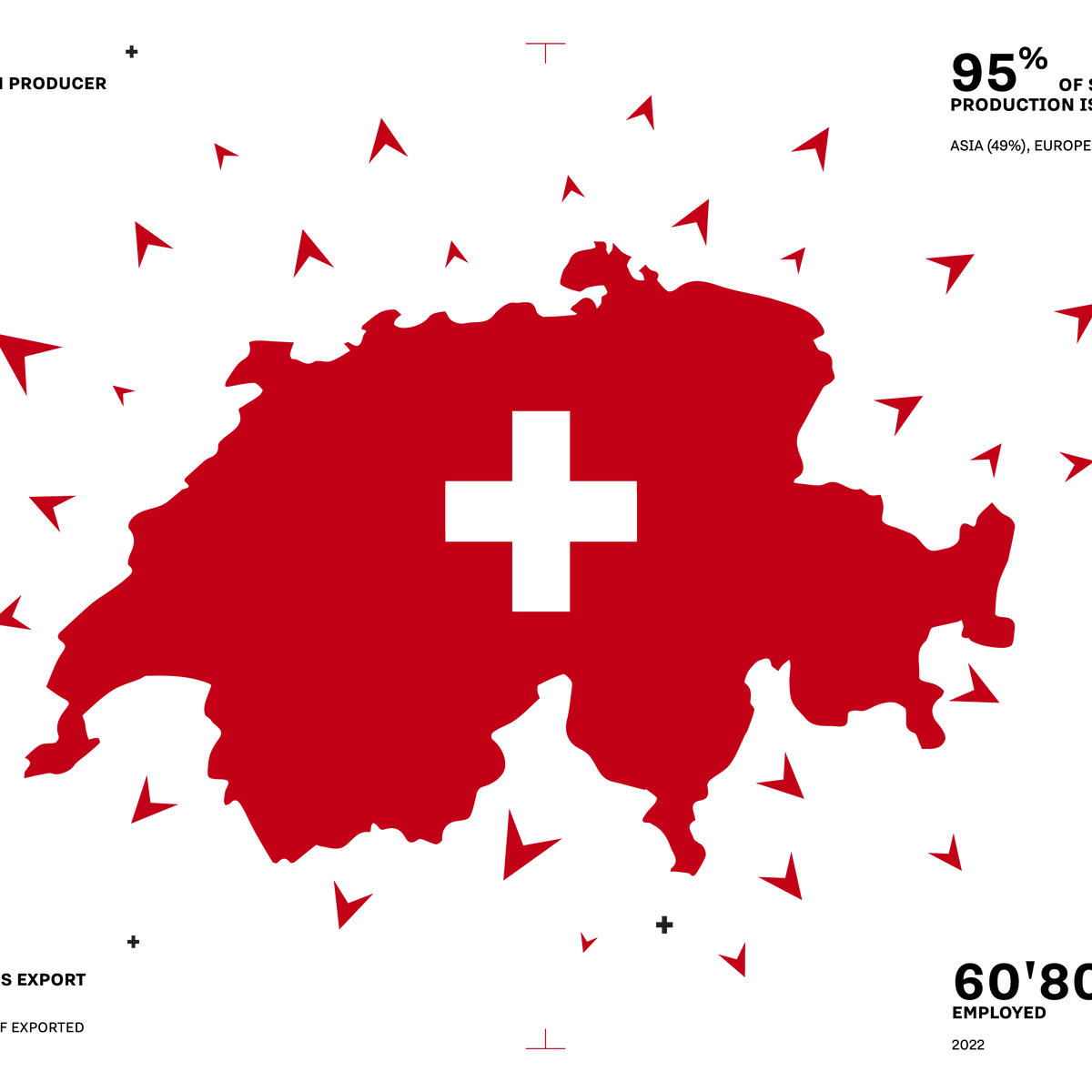

- The country’s third largest exporter at CHF 24.8 billion in value (2022)

- A major employer with a labour force of 60,800 people (2022)

- The world’s biggest watch producer in value, ahead of Hong Kong and China

- It exports 95% of its production, mainly to Asia (49%), Europe (30%) and the Americas (19%)

A view of the Swiss watch industry. A view of the Swiss watch industry. A view of the Swiss watch industry. A view of the Swiss watch industry. A view of the Swiss watch industry

A view of the Swiss watch industry. A view of the Swiss watch industry. A view of the Swiss watch industry. A view of the Swiss watch industry

A view of the Swiss watch industry

by Christophe Roulet

Switzerland’s watch industry is:

Should someone stop and ask you “what time is it?” (admittedly a rare occurrence, now that we have the time on our phone), there’s a possibility you will check your Swiss watch before answering. In which case, if you’re outside Switzerland, your interlocutor may well cast an admiring glance at your wrist. If you’re in Switzerland, chances are he or she will try to spot the name on the dial. The fact is, anyone who is interested in watches is especially interested in Swiss watches - a product so closely associated with its country of origin to have become almost a cliché but also one that has no equivalent. However, a Swiss watch hasn’t always been the “superproduct” it is today…

A spot of history

Back in the seventeenth century, any Swiss watchmaker seeking fame, if not fortune, would leave the Alpine nation behind and head for Paris (London, Dresden and Saint Petersburg were other possible destinations), in the hope of finding patronage among royal households and their entourage, where the “greats” of this world dreamed of ruling not just over a country but also over time. Then, in 1685, King Louis XIV revoked the Edict of Nantes and some twenty thousand French Protestants, deprived of their religious liberty, crossed into Switzerland. With them came many talented artisan watchmakers who set up in Geneva and along the Arc Jurassien (the region dominated by the Jura mountain range that lies between the two countries). Their arrival gave a welcome boost to what had previously been a secondary activity, providing farmers with a small income during the off-season.

The nascent watch sector benefitted from a hardworking and skilled labour force which, combined with intelligent division of labour and the country’s innate practicality, laid the foundations for an industry that would take on the world. With remarkable success! Of course there was competition from France, England, Germany and, later, the United States, none of which gave up without a fight, not to mention the consequences of global armed conflict, but since the mid-twentieth century Swiss watchmaking has reigned supreme. This hegemony was temporarily shaken by the onslaught of Japanese electronic watches in the 1970s but remains unchallenged where mechanical watches are concerned. Yes, since the 2000s there has been an uptick in watchmaking in Germany, particularly in Glashütte, and in England too, but this comes down to a handful of manufacturers, some of which have already been subsumed into Swiss entities. As for the independents working across the globe, from the Netherlands to Japan, the United States to Russia, they cater to a niche market of mainly collectors.

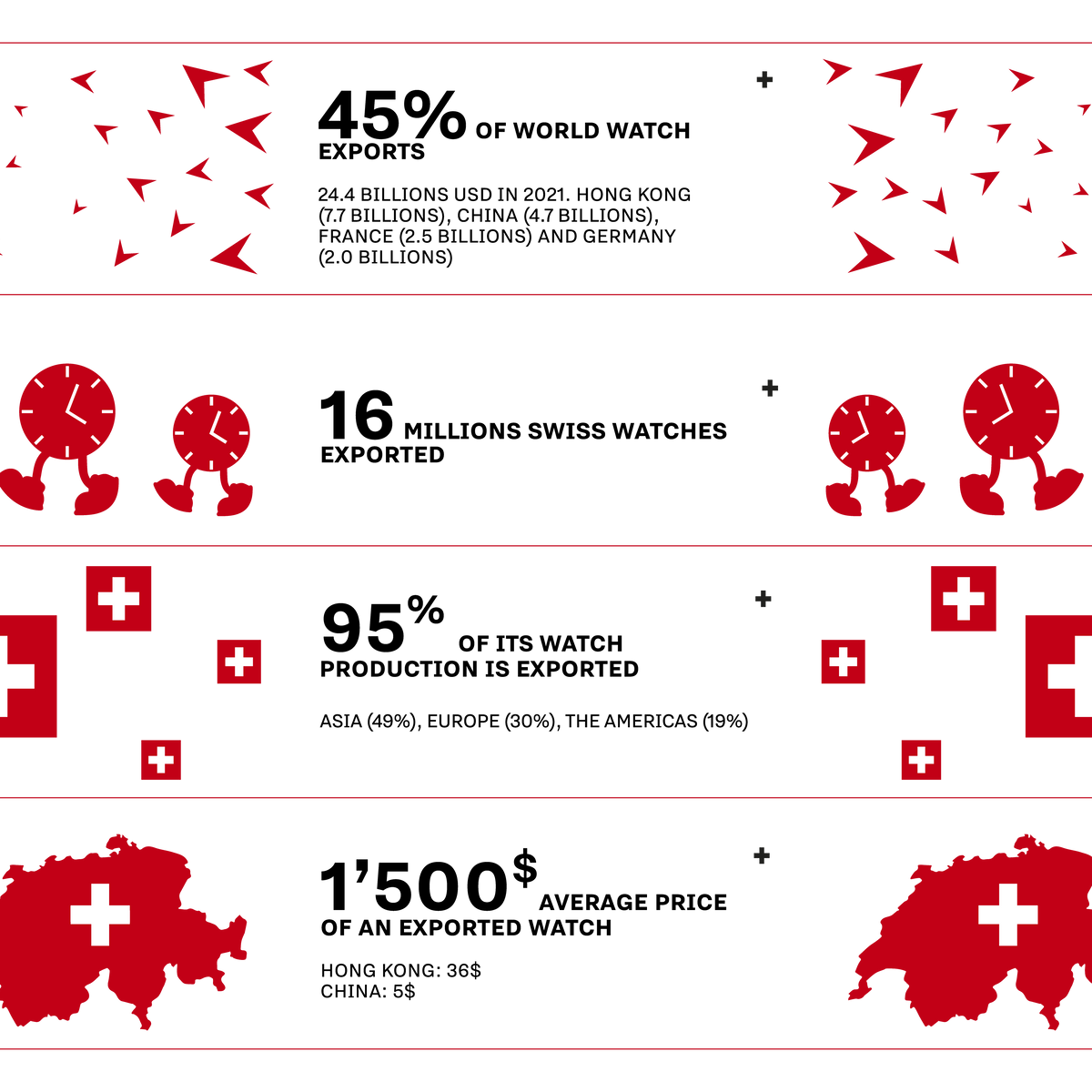

World champion

Export figures leave no doubt as to who the heavy hitters are. With a value of USD 24.4 billion in 2021, Switzerland accounted for 45% of global watch exports; factor in re-exports from Hong Kong and this rises to more than fifty per cent. An administrative region of China, Hong Kong is the second largest global exporter at USD 7.7 billion, ahead of China (4.7 bn), France (2.5 bn) and Germany (2 bn). In other words, Swiss watches have an export value three times greater than that of their nearest rivals. But are we comparing like with like? The average price (at export) of a Swiss watch is around USD 1,500. Compare this with the USD 36 average value of a watch shipping from Hong Kong and USD 5 for China.

A look at the figures shows how global watch production is structured. In volume terms, Switzerland is dwarfed by the Asian giants such as China, which exported 430 million watches in 2021, and Hong Kong with its 160 million. In comparison, that same year Switzerland shipped 16 million watches out of an estimated total world production of one billion. Turn this into value however and, as we have just seen, it’s a very different picture. Swiss watches, and mechanical watches in particular, represent high added value. Crunching the numbers, in 2021 mechanical watches accounted for 37% of the total number of Swiss watch exports (six million out of 16 million) but represented more than 85% in value. At retail prices (the final selling price to the end consumer), Swiss watch exports amounted to some CHF 55 billion.

The quartz quandary

After three glorious decades of post-war growth, when exports shot up from less than CHF 500 million in 1945 to exceed CHF 3 billion in 1974, Switzerland’s watch industry faced one of the most devastating periods in its history. Between 1970 and 1985, six out of ten workers in the sector lost their job. The situation arose from multiple factors, starting with the oil crisis and the appreciation of the Swiss franc against other main currencies. Between 1970 and 1974, the franc surged 58% against the dollar. The quality of Swiss watches was unchanged but their ability to compete on international markets was all but wiped out.

This leaves one last, crucial factor: lulled by prices that were guaranteed through cartel agreements, Switzerland completely missed out on quartz - despite mastering this cheaper technology. From a product built to last generations, the watch became a mass consumer item; an inexpensive accessory to be worn for as long as it was fun then thrown away - and one that gave the time with infinitely greater precision. Hundreds of Swiss watch manufacturers went bankrupt because they had failed to grasp the importance of this new technology. In the space of fifteen years, their number fell from 1,618 (in 1970) to 634 (in 1985). Employment similarly dwindled: in 1970 the Swiss watch industry directly or indirectly provided jobs for more than 90,000 people. Fifteen years later, this had plummeted to thirty-three thousand.

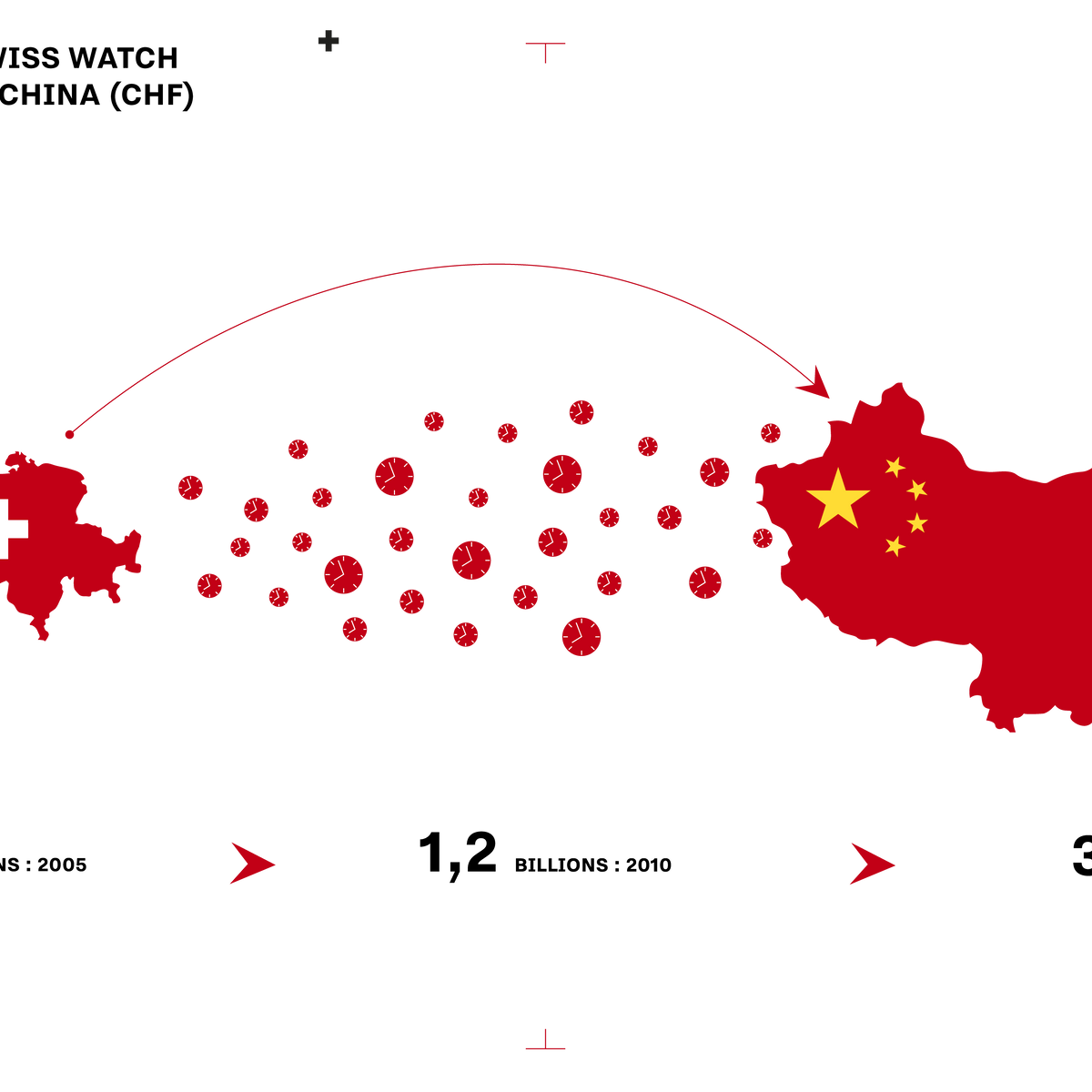

Shipping to the world

Incredibly, the Swiss watch industry came back from the brink of disaster. By repositioning production at the high end of the market and having successfully rebranded the mechanical watch as a luxury product, it reaped the benefits of the global boom in demand for premium goods that took hold in the mid-1990s. This success was also partly down to the fact that Swiss watchmakers had made strong, early moves into emerging markets. Since the middle of the 2000s, Asia has been driving exports. To give just one example, in 2000 China didn’t rank among the top twenty destinations for Swiss watch exports, having shipped in watches to the tune of USD 50 million. By 2005 this number had soared to USD 394 million, reaching USD 1.2 billion in 2010 and more than doubling to exceed USD 3 billion in 2021. As a result, China (excluding Hong Kong) is now neck and neck with the United States as the main export market for Swiss watches.

This eastward expansion means a better balance of business opportunities over a wider geographic area. With the world as their playground, Swiss watchmakers can take advantage of regional economic cycles to offset underperforming markets with strong sales elsewhere. By way of example, the Far East now accounts for 30% of Swiss watch exports, on a par with Europe and ahead of the Americas (19%), Middle East (9.6%) and other Asian countries (9.6%). One out of two Swiss watches (49%) ships to Asia (including Japan). This fabulous upsurge has produced record export levels (CHF 24.8 billion in 2022) and boosted employment. In 2022 the number of people working in the Swiss watch industry had doubled compared with the 1980s to more than sixty thousand.

Think big

The Swiss watch industry of the past two decades has witnessed several substantive trends. Industry concentration is one, with multiple takeovers, the emergence or consolidation of major watch groups and the arrival of luxury players. This has resulted in a highly polarised structure (the case for many industries). Of the two hundred or so Swiss watch brands, a small number – listed companies or privately-held by a family or a foundation – have captured around two-thirds of the market. Alongside them are the dozens of smaller firms that provide all-important diversity. Another key trend has been the emergence of a “new wave of watchmakers”, so-called in reference to the 1960s French New Wave in film. These independents now form a well established category and offer an alternative to big-name brands with watches that implement traditional techniques as well as high-tech innovation.

Whether independent or part of a group, watch industry players can therefore be categorised as:

- Heritage brands

- Contemporary brands set up by an independent watchmaker

- Luxury brands with a strong watch division

- Artisan-creators emphasising hand-craftsmanship

This concentration has occurred alongside greater vertical integration. Brands wishing to control the entire value creation chain, from the smallest component to assembly of the finished watch, have bought out suppliers or invested in their own production capacity. Two of the main drivers of this trend have been the decision by Swatch Group to limit sales of components and movements to brands outside the group, and a desire for exclusivity as well as independence that will guarantee continued supply, in particular during periods of high demand. As a result, over the past two decades there has been a significant increase in the number of manufacturers with the almost total capacity to design, develop, produce, assemble and market their watches.

Swiss Made

New ”Swissness” legislation came into force on January 1, 2017. Under the amended trademark protection act, adopted in 2013, for an industrial product to qualify as “Swiss Made”, at least 60% of the manufacturing cost must be incurred in Switzerland. The activity that gives the product its “essential characteristics” must take place in Switzerland. For watches, this includes construction and prototypes.

As the Federation of the Swiss Watch Industry (FH) notes, manufacturing costs include assembly costs, research and development, and costs relating to quality assurance and certification which are prescribed by law or regulated by the sector. At least one essential production operation must be carried out in Switzerland. Whereas previous legislation applied only to the movement and final inspection, the latest provisions concern the entire watch.